By Clare Chapman for Enlivening Edge Magazine

Premier League clubs spend record £815m in January transfer

What a strange world we live in, when we pay minimum wage to the people who do valuable work keeping our streets and homes clean yet we have a football club which will pay a signing fee of £106.8m for one footballer (Enzo Fernandez). No doubt there is a business case to be made for this valuation, though I find it hard to square the numbers, not being a football fan.

It interests me though, because it highlights the role that money plays in our businesses and how we can become detached from the reality that footballers are people, not assets to be capitalised on the balance sheet and amortised over their useful lives to the club, i.e. the length of their contract. And that cleaners too are people, entitled to live healthy, fulfilled lives.

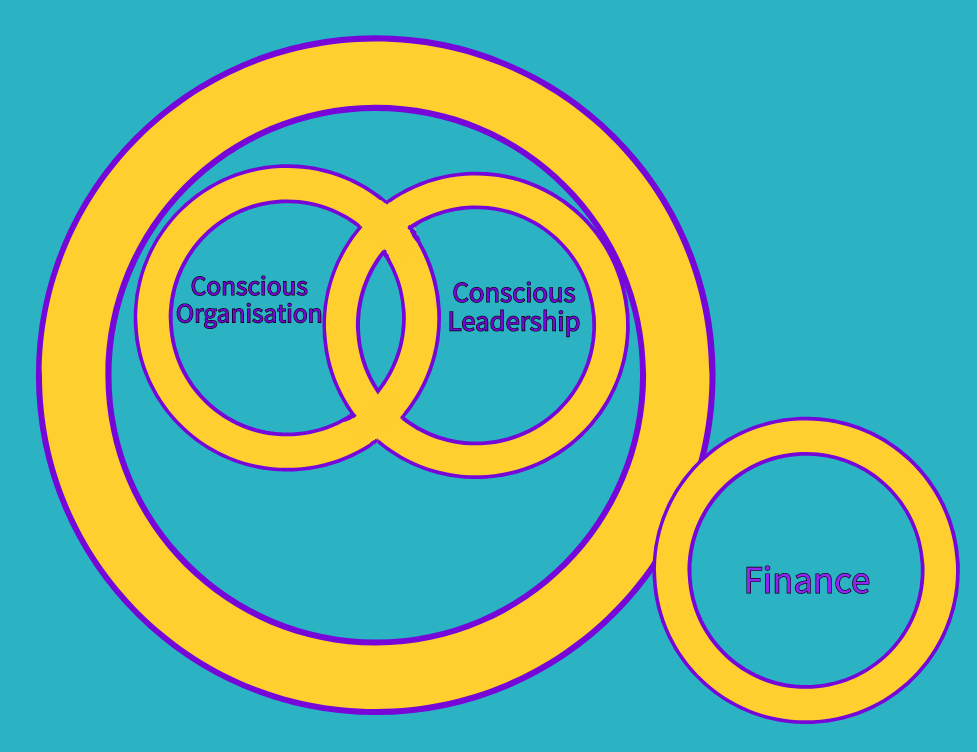

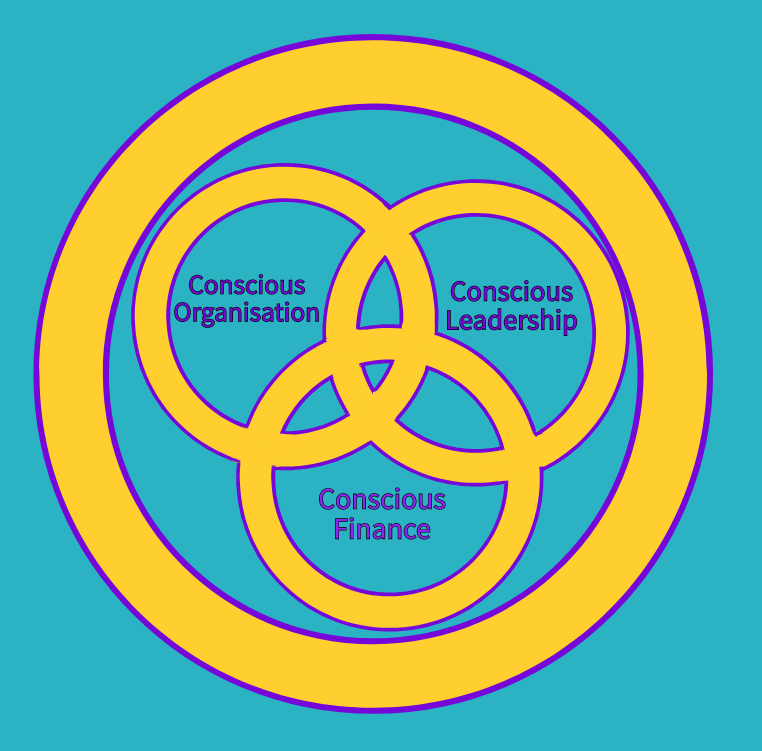

As you are reading this article, I suspect you are already well aware of the need for conscious business and have a desire to work in or with conscious organisations who strive to have a balanced relationship with their different stakeholders. I also suspect that you are familiar with conscious leadership, a second critical pillar in the evolution of conscious business.

There is a third pillar which is not always visible in conscious business conversations. It is the money pillar. I call this pillar “Conscious Finance.”

If we look at the three pillars through the lens of goodness, beauty and truth, we see

- conscious organisations as the goodness, the “We” space, where we come together to meet a need and do no harm;

- conscious leadership as the beautiful, the “I” space, the inner and outer work we do to be the best leaders we can be and to see the beauty in all relationships; and

- conscious finance as the truth, the “It” space which tells the story of our organisation through numbers and narrative, taking responsibility for our impact in all aspects of our activities: the internalities and the externalities.

This third pillar is so often siloed and left in the old paradigm of only money matters, having a much greater, and I would say subconscious, influence on our decision-making than we care to know. How often do we put our conscious ideals aside while we deal with a financial crisis which seems to demand a less-than-optimal action to secure our survival? How often do we want to engage in social impact investing as long as we get a similar return to mainstream investing? Why do good ideas like decentralised currencies end up becoming commodities?

To be truly successful and balanced conscious businesses, we need the 3 pillars. We have guidance for developing conscious organisations and conscious leadership, which help us to be constantly evolving, deepening, transcending and including all the good which has got us to here. Where do we go to develop this third pillar?

Conscious Finance gives a framework for looking at money in a positive way. Using the “Commitments of Conscious Finance” and gaining an understanding of what is fair exchange in all transactions, we can learn to relax around money so that discussions and decision-making are transparent and truthful.

Conscious Finance calls on us to take radical responsibility for our money story. Funda-mentally, getting to know what money is, what it means to us as an individual and how we relate to it is a critical part of being a conscious leader, running a conscious business. If we are not familiar with our own money story, then we cannot expect to know what role money is playing in our decision-making. We do not recognise when fear and scarcity is driving us—or if we do, we don’t know how to move beyond this state.

When we observe ourselves as we engage in conversations or activities which involve money, we can start to uncover our unconscious fears, biases, judgments, and beliefs. We do as Carl Jung advised, we make the subconscious (money story) conscious so that it no longer directs our lives and we no longer call it fate. We do our shadow work through the medium of money.

Conscious businesses create conscious cultures. This can—must— include creating a Conscious Finance culture where money can be talked about openly, as without that we are all in relationship with each other with only the tip of the iceberg on view.

It is imperative that we understand our true motives for having a good purpose. It is likely that wanting to do good is a strong motive, however we frame ‘doing good’. It is also likely that we want to earn our livelihood and provide others with a livelihood while fulfilling a good purpose.

We need to be honest enough to learn how making and having money influences our purpose. Or indeed, how NOT making money might be more comfortable for us. If there is a disconnect, such as a belief that making money may make us look greedy, we might set up a ‘not-for-profit’ organisation which stymies the growth of the organisation. Insufficient capital and cashflow will eventually starve an organisation, no matter how good its purpose is.

Money shows us how interdependent we are on each other; it shows us how we value each other, how we are in relationship with each other. It can show us our generosity and it is like a tracer dye which shows us where we leak energy. Money is a mirror of relationship. I believe this awareness of money is profound and fundamental. It is why Jeff Vander Clute describes money as a powerful awakener of human consciousness and a Sacred Ally.

When we practice conscious business, we move from transactional to relational activities, deepening our trust and strengthening our relationships with all of our stakeholders. When we overlay this with Conscious Finance, we can truly use business as a generator of good, and create prosperity for all.

Clare Chapman is a Chartered Accountant who has been exploring money through a conscious business lens. She wants to change the way we perceive money by inviting us to explore our relationship to and with money, while offering a deeper understanding of what exactly money is.

Clare believes we can bring finance in out of the old paradigm of scarcity to create Conscious Finance, embedding it in the heart of our organisations.

You can read more about Conscious Finance at https://consciousfinance.co.uk/